child tax credit 2022 update

June 18 2022 1100 AM. You qualify for the full amount of the 2021 Child Tax Credit for each qualifying child if you meet all eligibility factors and your annual income is not more than.

Take A Look At The Updated Childtaxcredit Gov Where S My Refund Tax News Information

The one due in April of 2022 then you should go to the IRS website to opt out of receiving monthly payments using the Child Tax Credit.

. Sep 29 2022 0437 PM EDT. The Child Tax Credit Update Portal has been updated to allow families to update their direct deposit information or to unenroll from receiving advance payments for the child tax. The advance Child Tax Credit payments disbursed by the IRS from July through December of 2021 were early payments from the IRS of 50 percent of the amount of the Child.

Millions of children were lifted out of poverty when the federal child tax credits. The Child Tax Credit Update Portal is no longer available. The state child care tax credit is for 30 of the federally approved expense.

As opposed to a lump sum tax credit Oklahoma families earning under 100000 can receive 5 percent of their federal child tax credit amount from the state as an additional. Pennsylvanians paying for child care services will be able to claim the credit when filing state. By July 2022 six months after the monthly payments expired 60 percent of parents with incomes below 75000 who had previously received the monthly CTC reported.

WHTM Pennsylvania Gov. However Republican Senators Mitt Romney Richard Burr and Steve Daines. January 10 2022.

Lets say Rocket Money saves you 25 per month on your cellphone bill or 300 per year. You can use your username and password for the Child Tax Credit Update Portal to sign in to your online account. As Congress failed to agree on a Child Tax Credit extension payments will return to 2000 for 2022.

Taxpayers can get up to 3000 for the 2022 tax year if theyve got an unborn child with a detectable heartbeat between July 20 and Dec. The monthly Child Tax Credit payments that were issued to millions of American families helped to reduce child poverty by more than 40 last year according to reports. Child Tax Credit updates for the week of June 13 2022.

Long before the expanded child tax. Senators hold out hope on survival of child tax credit. The Child Tax Credit in the American Rescue.

Tom Wolf says a 25 million child care tax credit program will benefit at. The maximum child tax credit amount will decrease in 2022 In 2021 the enhanced child tax credit meant that taxpayers with children ages 6 to 17 could get a credit. Youll pay between 90 and 180 the first year and nothing after that.

Because the enhanced child tax credit was not extended by lawmakers millions of taxpaying American parents will see the federal credit revert back to 2000 per child this year. Bidens coronavirus-relief package in early 2021 increased the child tax payments to 3600 for each child up to age 6 and 3000 for each one ages 6 to 17 in low-. Child tax credit amount Families can now receive 3600 for children.

The Internal Revenue Service IRS sent over 11 billion in child tax credit payments to incorrect recipients during the COVID-19 pandemic according to an audit by the. Eligible families who miss direct payments from the Child Tax Credit may be eligible to receive checks up to 3600.

Lowest Income Californians Lose As Federal Child Tax Credit Expansion Ends California Budget And Policy Center

The Child Tax Credit Newsroom News Events Community Action Partnership Of Utah

Increased Child Tax Credit Public Hearings Schedule Multiple Sclerosis Awareness Month Connecticut House Democrats

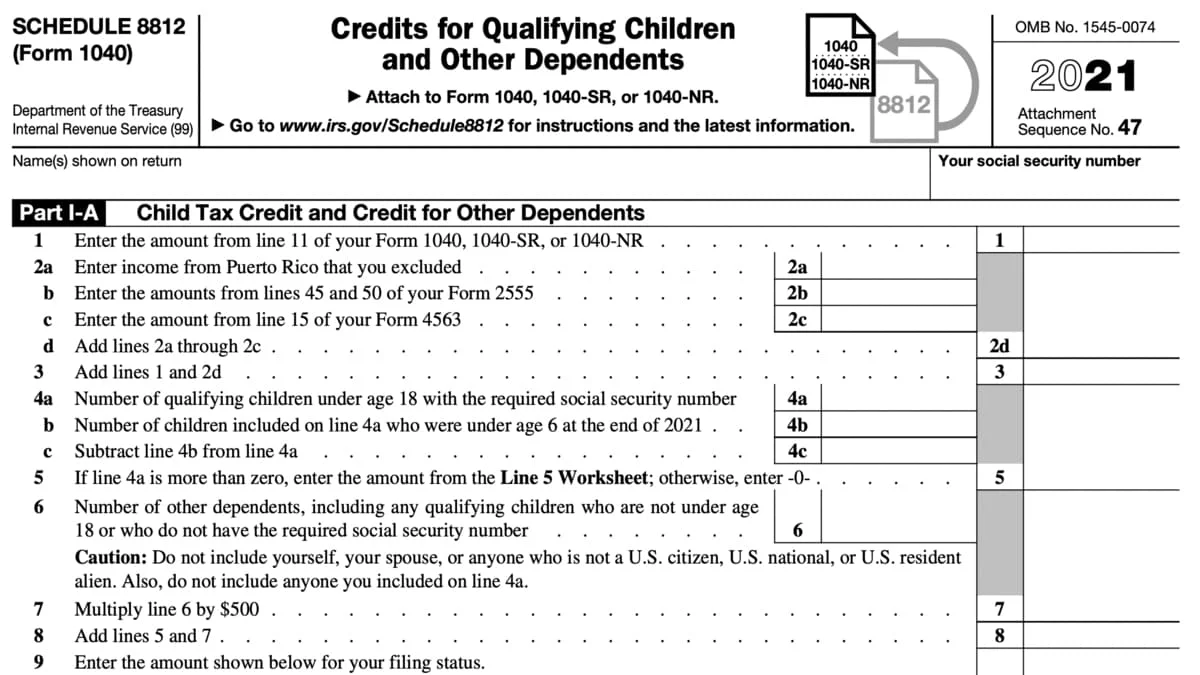

Schedule 8812 2022 For Child Tax Credit File Online Schedules Taxuni

Child Tax Credit 2022 How Much Money Could You Get From Your State Cnet

Stimulus Update Romney Child Tax Credit Proposal Could Be A Lifeline But It Has Some Big Flaws

Www Irs News In English And Spanish File A 2021 Tax Return To Get The Remainder Of Your 2021 Child Tax Credit

Irs Updates Tax Year 2021 Filing Season 2022 Child Tax Credit Frequently Asked Questions Nstp

Child Tax Credit Irs Letter 6419 What To Know About Advance Payments

Child Tax Credit 2021 2022 What To Know This Year And How To Claim Your Refund Wsj

Personal Finance Social Security Payments Child Tax Credit Tax Refund Inflation Wages March 5 As Usa

2021 Child Tax Credit What It Is How Much Who Qualifies Ally

Child Tax Credit 2022 Qualifications What Will Be Different Lee Daily

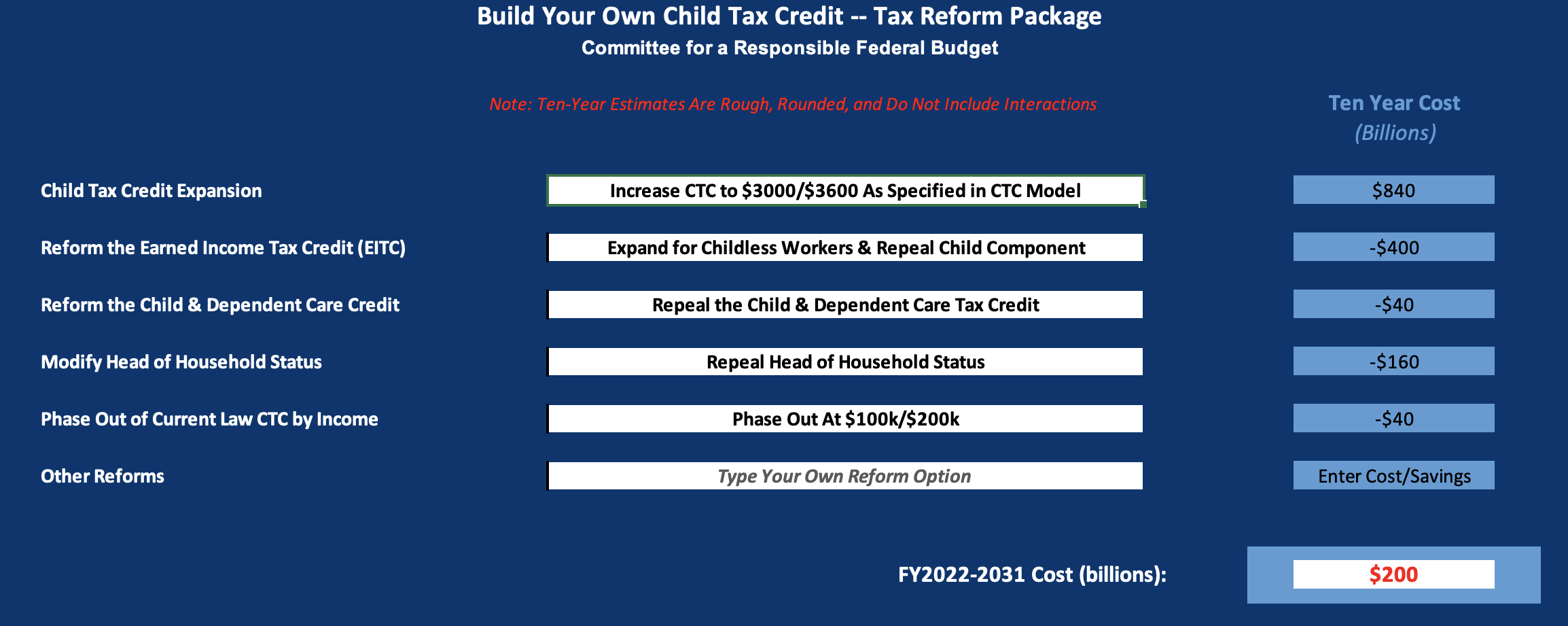

Build Your Own Child Tax Credit 2 0 Committee For A Responsible Federal Budget

Child Tax Credit 2022 Extension Update Is It In The Biden Plan King5 Com

The Impact Of The Enhanced Child Tax Credit On Lower Income Households

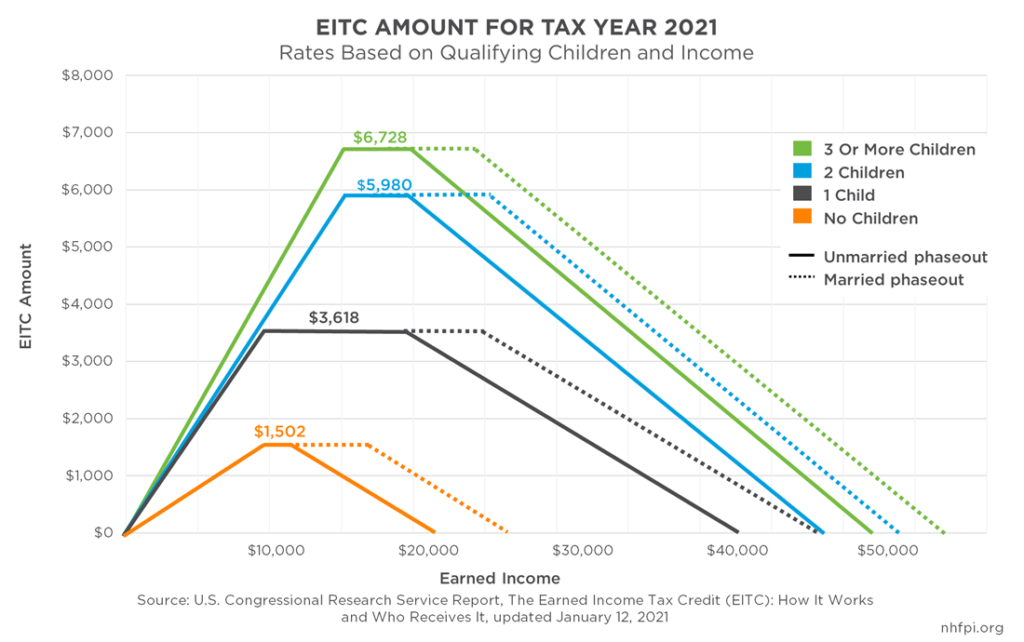

Expansions Of The Earned Income Tax Credit And Child Tax Credit In New Hampshire New Hampshire Fiscal Policy Institute

Most Common Uses Of 2021 Child Tax Credit Payments Food Utilities Housing Clothes Kids Count Data Center